This decade is proving to be a testing period for human (and investor) resilience.

Early 2020 brought the most virulent global pandemic in a century, with 767,000,000 worldwide infections. The result, an instantaneous collapse of global GDP as economies shut down and normal life went on hold.

On 8th December 2020, the first COVID19 vaccine was administered, reviving our optimism. Quickly, it became evident that the supply of manufactured goods would not match the post-COVID appetite to spend and consume. This imbalance opened the door for inflation to reappear, following a prolonged period of anemic price increases and record low levels of interest rates and bond yields.

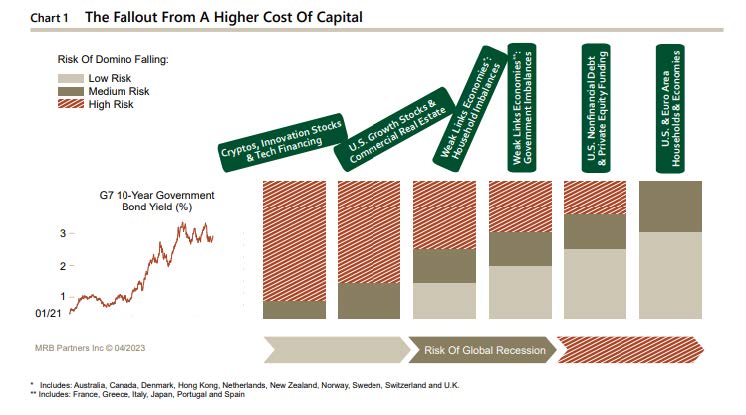

Just as markets started to respond to this inflationary threat, hostilities broke out in Ukraine, an invaluable global producer of sunflower oil, barley, corn, wheat and rapeseed. Shortages of these ingredients caused food price inflation to soar to levels not seen in 45 years. Central banks have responded by ratchetting up interest rates at the fastest pace on record. This, in turn, resulted in the financial dominoes starting to fall (Chart 1 below), the most recent being the collapse of 3 US regional banks and the forced rescue of Credit Suisse in Switzerland by its larger counterpart UBS.

Chart 1.

For investors, wrong turns have abounded in this complex web of variables. The issue facing investors now is where are the opportunities, where are the potential ‘dead ends’ and how do you take advantage of (or avoid) them?

Finding profitable trends is the key. For example;

- Post COVID, we all decided to travel more and enjoy a better work / life balance. Being exposed to the quality part of the travel and leisure industry is an ideal way to profit from this trend, which has been boosted further in 2023 by the recovery in emerging market travel.

- Global instability and increasing political tensions are putting the spotlight on defence and security budgets. Europe and the US provide investment opportunities on both the defence and commercial sides of the aviation market, coupled with the modernization of global airline fleets and the need for adherence to strict emissions targets.

- A key future theme is the modernization of our technology and household goods to incorporate Wi-Fi capabilities and AI. This creates demand for chips to control these devices so exposure to semiconductors, software and the vertical manufacturing and supply chain for chips is a secular growth opportunity.

- Despite a fog of heavily negative sentiment surrounding Chinese assets, economic momentum is advancing steadily. The expansion is fuelled by consumption and services, financed primarily by a drawdown of precautionary savings piled up during last year’s lockdowns. The ‘China Story’ has become more nuanced and has shifted from the previous dependence on property and heavy manufacturing. So far, gaining exposure to this via developed market (primarily European) companies has been more beneficial than investing directly.

- Regionally, there is evidence that the beneficiaries in this next phase will be European rather than the US companies. Since 2011, the equity markets in the US have outperformed those in Europe but there are signs the tide is turning and funds are flowing to Europe from the US where valuations are cheaper, and prospects are potentially better (Chart 2).

Chart 2 – 12 month European equity performance versus the US, China and Global indices. Source: Bloomberg.

Industrial companies make up a notable proportion of European indices where US indices tend to have greater exposure to highly priced technology companies. Breaking the 12-year dominance of US markets will take time but the new trend should last an extended period. Any signs of a weaking US dollar will only encourage this transition.

Ultimately the exit to the 2020’s labyrinth is in making smart choices, maximizing potential from themes, diversifying by industries and being aware that European markets are beginning to recover from very low levels of global ownership.

The investment landscape has changed beyond recognition in just three short years. To prosper in the medium-term, exposure to different style factors, new themes and recovering investment regions will all need to be considered. The early 2020’s will be remembered for all the wrong reasons, but the fallout might be an environment that is new and exciting for investors.