February was a strongly positive month for developed equity markets, as economic resilience and relatively strong earnings reports for the final quarter of 2023 contributed to year-to-date gains. Earnings momentum and a broadening of upward revisions across sectors and markets provided a tailwind for stock prices, despite the growing view that monetary policy will remain restrictive for longer across the US and parts of Europe.

With 97% of companies having reported, S&P 500 Q4 GAAP earnings per share were +22% above the prior year, which is the highest growth rate since Q4 2021. The forward 12-month earnings per share estimate for the S&P500 also rose to a new high, some 4% above the 2022 peak, supporting new highs for the S&P500 and Nasdaq, whilst on a broader basis, global equities also broke above their previous peak level of January 2022.

Although market concentration is mirroring the earnings revision concentration in certain sectors, there is evidence that, selectively, this is broadening to other sectors, and non-US markets. The continuation of resilient US economic growth, coupled with anticipated recovery in Europe and emerging market demand, should support this trend further in 2024.

With this in mind, we believe it’s important to maintain exposure to other areas of the market that have better valuation support and lower earnings bars to hurdle. Specifically, this includes sectors such as healthcare, industrials, energy, financials and defensives (staples). The below table shows that there is tentative evidence that this ‘laggard rotation’ is underway.

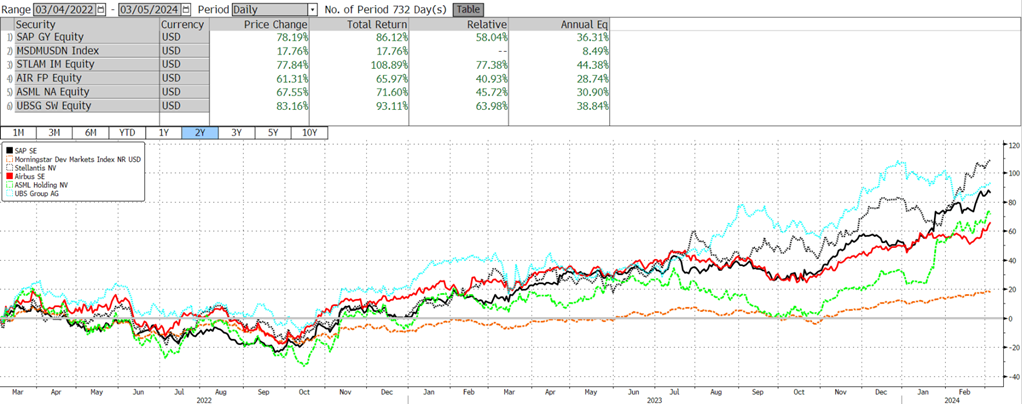

Although European markets underperformed the developed world market benchmark at an index level in February, we are seeing some strong contributions from select European stocks in our portfolios on a year-to-date basis. These include: ASML (+34% in USD ytd), SAP (+26%), Airbus (+11%) and car manufacturer Stellantis NV (+16%). During the month we also added Rolls Royce and Novo Nordisk to the Martello Global Equity fund as part of some wider changes to the portfolio construction methodology for our global equity strategy – further details on these changes are included in February’s fund factsheet.

We note there has been a pick-up in research notes and recommendations for Europe as an investment option during 2024 to date, supported by several markets there hitting all-time highs. We see this as very positive, with valuations in the region at a significant discount to the US whilst Europe also offers exposure to sectors and globally-leading companies that compete favourably with US-listed counterparts, and feature in the Martello Global Equity fund.

From their relative low-point of October 2022, these companies have significantly out-performed the global equity benchmark and, importantly, see improving prospects for guidance uplift in 2024. The current weighting to Europe in the fund is 34%.

Source: Bloomberg

The latest factsheets for the Martello Global Equity fund and the BCI Martello Global Equity Feeder fund can be found here.

Performance data for our segregated strategies can be found here.

For further information on our funds and segregated strategies, please contact Gary Hill garyh@martello-am.com or Tom Papenfus thomasp@martello-am.com