Global equities enjoyed a strong opening month, continuing the recovery since early October and reflecting a moderate re-rating in forward P/E ratios towards their post-1990 average. This positive sentiment persisted for much of the month, led by evidence of cooling inflation, a reopening of Chinese borders and some strong quarterly earnings releases. New uptrends in more cyclical sectors and the relative outperformance on non-US markets also pointed to improving breadth.

The Martello Global Equity Fund A Class returned +5.76% in January in USD terms, versus the Morningstar Developed Markets Index return of +7.21%. Sector performances throughout January were led by some of least favored sectors of 2022 – the best performing sectors were consumer discretionary and communication services up (+14.59%) and (+13.11%) respectively.

Both sectors were down by more than 30% during 2022, highlighting how market sentiment can shift quickly. We are yet to see confirmation, however, that this change in sentiment is more than a relief rally from very depressed levels, especially as this rally has yet to be supported by improving earnings in many cases. We remain underweight to these sectors, but increased our exposure to technology (semi-conductors and software), travel and industrials stocks during the month.

On the 8th of January, China reopened their air, land and sea borders which had all been shut since the start of the COVID pandemic. This has been a long-awaited update from one of the world’s most strictly locked down nations following the outbreak and supported investor sentiment via an improved outlook for exporters (to China), commodity producers and travel companies.

Global Inflation data released throughout January continues to show evidence of easing in annual cost increases. Figures for both the US and UK came in ahead of consensus, both showing signs of meaningful slowing, although still very elevated when compared to the 10-year average. The resilience of service sector costs and wages remains problematic however, a factor that was reinforced by the surprisingly strong US jobs data in early February.

Looking to commodities, oil has traded between $70 and $80/barrel since the start of the year. There is still possible upward pricing pressure to come through from the China reopening, once manufacturing restarts and inventory increases meet a tightly supplied market. US Natural Gas has continued to fall, decreasing -28.40% in January alone. Increasing production within the US and lower exports than expected to Europe are potentially responsible for this.

When looking at the fund, the best performing sectors for January were, consumer discretionary (+20.64%), utilities (+14.62%) and financials (+8.86%). The worst performing sectors were consumer staples (-4.49%) and health care (-2.00%). On an individual stock basis, the pest performing stocks for the month were ASML (+21.78%), Hyatt Hotels (+20.64%) and American Express (+18.82%). The laggards for the month were Johnson & Johnson (-7.49%), P&G (-5.45%) and Kone (-4.22%). The latest factsheet for the Martello Global Equity fund can be found here.

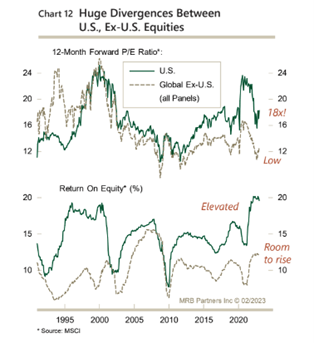

As we discussed in our outlook for 2023, we believe that the underperformance of U.S. stocks is consistent with the deterioration in relative 12-month forward earnings. Our forecast that the U.S. economy will continue to slow in the coming months while the euro area, China and other parts of the world pick up implies that the recent decline in U.S. relative earnings has further to run and could gather pace. At the same time, we are attracted by the re-rating opportunity that exists in Europe from both a forward earnings and return on equity point of view.

Our website has been updated with the performance of our US dollar and sterling segregated strategies for the month of January (Global Equity and Global Balanced) as well as the FundHub website which includes details of the BCI Martello Global Equity Feeder Fund (A).

Improving Trends For 2023

This article is for informational purposes only – please read our Terms and Conditions.

Global equities enjoyed a strong opening month, continuing the recovery since early October and reflecting a moderate re-rating in forward P/E ratios towards their post-1990 average. This positive sentiment persisted for much of the month, led by evidence of cooling inflation, a reopening of Chinese borders and some strong quarterly earnings releases. New uptrends in more cyclical sectors and the relative outperformance on non-US markets also pointed to improving breadth.

The Martello Global Equity Fund A Class returned +5.76% in January in USD terms, versus the Morningstar Developed Markets Index return of +7.21%. Sector performances throughout January were led by some of least favored sectors of 2022 – the best performing sectors were consumer discretionary and communication services up (+14.59%) and (+13.11%) respectively.

Both sectors were down by more than 30% during 2022, highlighting how market sentiment can shift quickly. We are yet to see confirmation, however, that this change in sentiment is more than a relief rally from very depressed levels, especially as this rally has yet to be supported by improving earnings in many cases. We remain underweight to these sectors, but increased our exposure to technology (semi-conductors and software), travel and industrials stocks during the month.

On the 8th of January, China reopened their air, land and sea borders which had all been shut since the start of the COVID pandemic. This has been a long-awaited update from one of the world’s most strictly locked down nations following the outbreak and supported investor sentiment via an improved outlook for exporters (to China), commodity producers and travel companies.

Global Inflation data released throughout January continues to show evidence of easing in annual cost increases. Figures for both the US and UK came in ahead of consensus, both showing signs of meaningful slowing, although still very elevated when compared to the 10-year average. The resilience of service sector costs and wages remains problematic however, a factor that was reinforced by the surprisingly strong US jobs data in early February.

Looking to commodities, oil has traded between $70 and $80/barrel since the start of the year. There is still possible upward pricing pressure to come through from the China reopening, once manufacturing restarts and inventory increases meet a tightly supplied market. US Natural Gas has continued to fall, decreasing -28.40% in January alone. Increasing production within the US and lower exports than expected to Europe are potentially responsible for this.

When looking at the fund, the best performing sectors for January were, consumer discretionary (+20.64%), utilities (+14.62%) and financials (+8.86%). The worst performing sectors were consumer staples (-4.49%) and health care (-2.00%). On an individual stock basis, the pest performing stocks for the month were ASML (+21.78%), Hyatt Hotels (+20.64%) and American Express (+18.82%). The laggards for the month were Johnson & Johnson (-7.49%), P&G (-5.45%) and Kone (-4.22%). The latest factsheet for the Martello Global Equity fund can be found here.

As we discussed in our outlook for 2023, we believe that the underperformance of U.S. stocks is consistent with the deterioration in relative 12-month forward earnings. Our forecast that the U.S. economy will continue to slow in the coming months while the euro area, China and other parts of the world pick up implies that the recent decline in U.S. relative earnings has further to run and could gather pace. At the same time, we are attracted by the re-rating opportunity that exists in Europe from both a forward earnings and return on equity point of view.

Our website has been updated with the performance of our US dollar and sterling segregated strategies for the month of January (Global Equity and Global Balanced) as well as the FundHub website which includes details of the BCI Martello Global Equity Feeder Fund (A).

Gary Hill

Investment Director