We commented in last month’s email about the early signs of a ‘pivot trade’ as markets moved quickly to discount a softer labour market and confirmation that disinflationary forces continued to build. Those early signs developed into a significant melt-up in bond and equity prices for the rest of November, with bonds having their best month since 2008 and many of our stocks (particularly in Europe) pushing on to pre-Covid and sometimes, all-time highs.

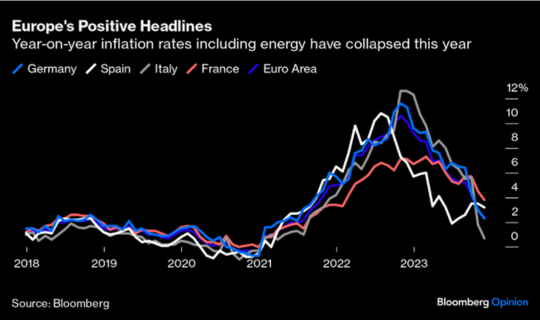

It feels like there have been several false starts to the ‘pivot trade’ since late 2022, and there are always risks that the resilient US economy may scupper this one (in terms of interrupting the downward glidepath for inflation). There are also signs that Europe has had the worst of it’s economic slump for the year, whilst recently China reported a host of datapoints that suggest manufacturing and buying levels are returning to growth, job shedding has eased and sentiment is on the rise.

Globally, macro data remains firm, or is improving and inflation data continues to decelerate. Although the rates market has moved quickly to price in earlier and more rate cuts in 2024, there may be a limit to how much flexibility the central banks will truly have unless conditions deteriorate markedly from here. Monetary conditions in the US and euro area economies have done nothing but loosen since Powell mentioned that the bond market was important in helping the Fed do it’s job of ‘tightening’ and global money supply is improving again (although in real terms, remains tight in Europe).

Together with the much weaker employment data in Europe (excluding the UK), and the prospect that eurozone unemployment may struggle further next year (EC Commission forecast), this suggests that the ECB may lead the way in cutting rates into 2024.

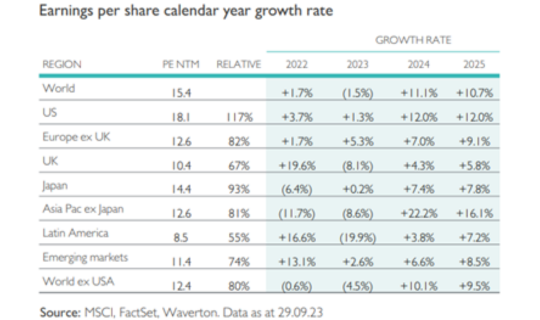

Over the past twelve months, European stocks have outperformed the US, lagged considerably during the middle quarters of 2023, and are showing signs of life once again. Their valuations look reasonable in absolute terms (see table below) but compelling relative to the S&P500 (even after stripping out the ‘super 7’ largest stocks), effectively at a level last seen in the aftermath of the financial crisis.

While the European macro environment has clearly been weaker than the US this year, it does appear that much of this negativity is now reflected in prices, particularly when considering that European indices only generate 40% of their revenue domestically. Conversely, for the US market to deliver another year of outperformance versus its European counterparts, a lot will be riding on the tech heavyweights, who will need to deliver on elevated earnings expectations.

The leading stocks in the Martello Global Equity fund during November include (returns expressed in USD): Amadeus IT Group (+20.5%), UBS Group (+21.3%), SAP (+18.5%), Chugai Pharmaceutical (+19.9%) and Monolithic Power Systems (+24.2%).

Amadeus posted strong revenue growth in it’s Q3 earnings, spread across all divisions, including higher volumes and new customers. The surge in profits and free cash flows also allowed for more debt reduction and the announcement of a €625m share buyback programme.

As expected, UBS announced a mixed set of Q3 figures as it continues to move quickly to integrate the takeover of Credit Suisse. It announced a higher-than-expected net loss for the quarter as it booked $2.1bn in expenses related to the takeover (including costs to retain key CS staff). On the plus side, net new money inflows and AUM growth were both strong, and the key common equity tier 1 ratio increased to 14.4% compared to a pre-merger level of 14.2%. Whilst we expect further upside for UBS, and the low price paid for CS provides a significant cushion for any further integration risks, the shares are trading well above their pre-merger highs and we booked some profits on our holding during the month.

As mentioned, we saw several holdings mark all-time highs during recent weeks, on the back of strong earnings and outlook guidance, including SAP SE and Vinci (still only trading on 13.2x PE for 2024). The recent additions, Monolithic Power, Chugai and Zoetis have all contributed strongly to returns since their addition in October. Since the end of November we have also added two further holdings, Stellantis NV and Garmin Ltd, which we will discuss in the next commentary, and have reduced our energy exposure further.

The latest factsheets for the Martello Global Equity fund and the BCI Martello Global Equity Feeder fund can be found at the following weblink.

Performance data for our segregated strategies can be found here.

For further information on our funds and segregated strategies, please contact Gary Hill garyh@martello-am.com or Tom Papenfus thomasp@martello-am.com

With Christmas just around the corner, we would like to take this opportunity to wish you a peaceful and relaxing festive season, and look forward to the opportunities of 2024. As Marty found out, being in the herd can have it’s rewards, but can also mean you miss out on opportunities!