2022 began with a heightened sense of uncertainty coupled with increased volatility within major markets. On a month by month basis the Morningstar Developed Markets index monthly return exceeded +/-5.00% for 7 of the 12 months during the year. 2021 was an exceptionally strong year and a correction was overdue, especially when the level of inflation and tightening monetary policies were factored in.

The positioning of portfolios was absolutely critical to rolling returns during the year as markets maintained their risk off stance with the largest sector laggards being technology, consumer discretionary and communications. Towards the end of last year we saw that energy was becoming more and more attractive versus other sectors in the market. This led to an initial weighting to the sector in September of last year, a weighting that was increased throughout the first quarter of this year. The energy sector was a top 3 sector contributor in 6 individual months of 2022 and produced by far the best overall sector return for the year as a whole.

Throughout the first quarter, there was also volatility and downward pricing pressure for fixed income securities due to the Fed beginning their rate rising cycle in March. This led to a traditional 60%/40% portfolio having one of the largest drawdowns on record, YTD in real terms (fig1.). Traditional theory suggests that a portfolio with a distribution of assets between equity and fixed income dampens volatility but during 2022 this was proven to be incorrect.

The communications sector (media streaming and data distribution) was a major beneficiary of the turmoil and disruption caused by the pandemic in 2020 and 2021. Companies such as Alphabet, Netflix, Disney, Facebook reaped the rewards of finding their audiences locked in their homes for many months during the height of the pandemic. This however created very complex and tough comparisons when earnings were released in 2022 as much of the earnings boost appeared as temporary as we emerged to a more normal lifestyle. This resulted in a total reassessment of the valuations for these companies, and most were found to be unsustainable. Most of the share prices revisited pre-pandemic levels causing considerable losses to many investors.

For much of the pandemic, energy demand was suppressed as manufacturers curtailed operations as demand evaporated during the lockdown period. A sudden economic boost, post lockdown, left energy and oil suppliers woefully unprepared after years of under-investment. The hostilities in Ukraine only served to restrict supply further resulting in a spike in oil and gas prices generating temporary excess returns for the suppliers of these essential commodities at the same time as extreme cost pressures were exerted on all heavy energy users. Our overweight allocation to energy stocks coupled with our underweight to technology put us in a good position for the first 5 months of the year.

Under the surface, however, increasing consumer spending, low interest rates and a hot labour market together with easing of lockdown restrictions meant that inflation was increasing at a rapid rate coming into 2022. January saw headline inflation in the US jump to 7.5% (fig2.) with central bank intervention and quantitative tightening needed. Inflationary pressures were not solely due to the energy suppliers, but higher energy costs feeding through the manufacturing system created an extraordinarily broad impact that resulted in price rises for virtually everything we buy. In order to retain their buying power, higher wage claims by consumers completes the virtuous circle of increasing prices generating high wages, creating yet more increasing prices.

The general themes have remained persistent throughout the year with the energy, healthcare and consumer staples sectors producing the most productive results and the technology, consumer discretionary and communications sectors finding 2022 very tough (fig3.). The differences in returns for these two groups is wide with the best three giving an average return of +11.59% and the worst three giving an average return of -28.79%. This highlighting just how important sector & stock allocation was in 2022.

The market is now focusing on the future. Will there be a meaningful recession in 2023? Will individual corporate earnings hold up? Will inflation continue to impact manufacturers and will recent inflationary pressures persist or dissipate during 2023? There are many views of the potential outcomes, but the generally accepted view is that a mild recession is likely in the USA, a deeper economic dip is probable in the UK and Europe and unemployment will likely rise across the globe as staffing is cut to salvage corporate earnings and margins.

We believe that much of these expectations are already priced into equity markets and further equity outflows will only develop in the event that this overriding scenario is notably shifted to the downside. It is evident that the pure number of variables will likely ensure there is no direct path to recovery. These variables include global interest rate direction, economic growth levels, inflation pressures, pandemic outcomes, Ukraine hostilities, the USA frictions with China and extreme currency volatility.

The variables are all interlinked making for a murky picture for anyone trying to identify, where we will be in 12 months.

Global Equity Fund review 2022.

Q1 2022

We entered 2022 showing an overweight to the energy sector, having bought holdings of BP and Exxon Mobil in September 2021. The timing of these additions to the fund put us in a good position early in the year. The start of the year turned out to be very tough for many investors but the Martello Global Equity Fund was notably protected in January and February due to our overweight to the energy sector and our underweight to the technology and communications sectors (fig4.).

By the end of February, the fund was showing a fall of -2.51% compared to the benchmark return of -7.71%. Inflows into the fund were also giving us the potential to add to our financials exposure such as Zurich insurance and Berkshire Hathaway and selected holdings such as Hyatt Hotels and Microsoft.

As the first quarter drew to a close it was clear that our positioning had greatly aided investors in avoiding much of the market volatility with the fund closing out the first quarter with a loss of only -1.39% some +4% ahead of benchmarks.

Q2 2022

The second quarter continued in this theme with our energy exposure prospering, our underweight to the technology and communications sectors also helped us to avoid heavy downside pressure. We decided to relinquish our holding of Amazon as it was becoming clearer that during the post pandemic phase it was becoming harder for Amazon to retain sales growth as consumers now had the option to look to the high street as well as online. In replacement we observed that commodity and raw material prices were on the rise and we began to add exposure to the sector through Glencore, a major supplier of many raw materials (fig5.).

In early May we removed Disney from the portfolio. Subscriptions to their streaming service appeared to improve early in the year, but it became evident that purchasing external content left the unit struggling to turn a profit. Excessive competition in the space from the incumbents Netflix and Amazon Prime meant the option to increase fees was removed and it now looks like this concept is for the longer-term breadth of the company rather than an instant benefit to profits. By the end of May 2022 the fund was now 6% ahead of its benchmark but was showing a dip of -7.19% for the year to date.

June was a very disappointing month for equity markets producing market returns of -7.66%. Most individual sectors showed deeply negative returns as recessionary fears were being raised and US 10-year treasury yields jumped to 3.5%, the highest for 10 years (fig6.).

Q3 2022

July was the toughest month for the Global equity fund as a rally in the hardest hit sectors for 2022 produced strongly positive performances for the technology, and consumer discretionary sectors. Technology, which had been in a downtrend since the start of the year posted a return of +14.50% over a 6 week period up to the end of July. Energy stocks, which had been positive for the entire 6 months of the year, were down -6.90% over the same period. Thankfully, as expected, over the next 3 months until the end of November, these sector trends had reversed with technology stocks down -11.10% and energy stocks up +16.00%. This just highlighting how abrupt and extreme the sector rotations were in 2022.

As technology sectors had been so hard hit in the first six months of 2022 there was always a risk of a temporary relief rally but the strength of this caught market participants by surprise. We believed that higher interest rates and the prospect of a global slowdown would mean that these sector moves would be brief and unsustainable.

There are times when longer-term actions and allocations are contrary to market moves on a shorter time frame. It is during these times that investment managers beliefs are really tested.

During the third quarter of the year, it was clear that a number of companies were being adversely affected by the heightened inflation which was coming through in earnings reported. There was also a post COVID lull, where stocks that had performed exceptionally well during COVID were brought back down to earth with earnings and growth targets being adjusted accordingly by the market. There were a number of mega cap stocks that missed earnings estimates and were heavily punished for it. Netflix, Google, Amazon, Meta (Facebook) and many others were impacted considerably because of the changing customer trends, reduced spending and lower than expected growth.

Q4 2022

Coming into Q4 our weightings and tactical asset allocations remained relatively consistent. We reduced our underweight to technology slightly and banked some profits in financials as well as increasing our weighting to Europe and the UK which has played out well thus far. Heading into the New Year, we will continue to perform another full global pricing model assessment. This provides us with insight, enabling us to assess existing and potentially new holdings within the fund.

Throughout the year on a YTD basis, our sector allocation has been the biggest contribution to alpha generation relative to the market. This demonstrates, that even in a volatile market, we can still rely on our inhouse relative pricing modelling capabilities to weather even the roughest of seas. Our outperformance versus benchmark, +4.14% has been generated by having overweights and underweights to the right sectors.

With regards to individual stock winners we had many successes during the year including Exxon (+87.36%), Schlumberger (+81.22%), BP (+34.14%), Zurich Financial (+15.00%) and AstraZeneca (+18.88%) (fig7.). All against a market performance of -18.31%. At the time or writing, YTD performance for the fund is -14.17% versus a benchmark return of -18.42% representing +4.14% of alpha generation for the year. Whilst negative absolute performance is never desirable, it is essential to minimize losses wherever possible.

2022 will go in the record as a very tough and volatile year. It was also a year where many investors’ methodologies were deeply tested. We believe that our very robust methodology proved itself again to be able to handle even the most volatile times whilst producing productive output.

2023 Outlook

Looking out into 2023, it is easy to get swept up with the negative and worrying rhetoric that seems to be so prevalent, currently. Granted, it is unlikely that equity market returns and the wider economy will match 2021 and caution cannot be thrown to the wind but there will be pockets of opportunity in 2023, as we have seen in 2022.

At Martello, we work with the facts as we see them rather than expectations about the future since these can change considerably as the year progresses. In place of listing a number of views about the year that may or may not come to fruition, it is more advantageous to go through some of the potentially more likely scenarios.

Over the past year, we have seen inflation in nearly all major developed countries increase at some of the fastest rates in history. Primarily due to COVID and its lasting effects on many supply / demand dynamics and hostilities in Ukraine. We have all also been impacted by inflation in the US, Europe and UK. Initially this was thought to be transitory by many central banks but this view has turned out to be mistaken. Thankfully, Inflation seems, potentially, to have now peaked in western economies.

We expect this trend to continue into 2023 (unless there is any substantial adverse effect from the Ukraine conflict) as pricing pressure coming through in the form of energy, food, used cars and raw materials is ebbing. Rising interest rates have also begun to dampen price rises and will likely continue to do so.

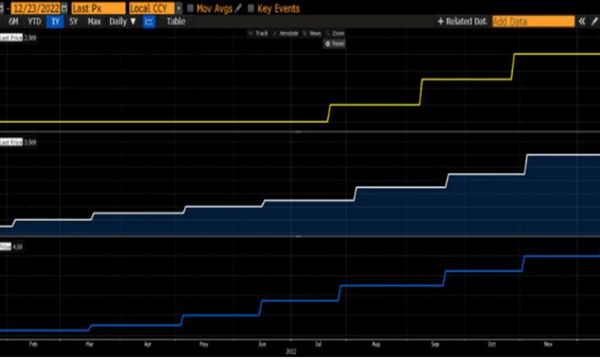

In response to the runaway inflation, central banks around the globe initiated some of the fastest rate rises in history to counteract the adverse effects. The US, the UK and the ECB have all increased rates considerably throughout 2022 (fig8.). At Martello, we expect these rate rises to slow and pause in 2023 as they are having their desired effect on inflation globally.

Many expect rates in the US to then begin decreasing later in 2023, however, we believe it is still too early to have any certainty. A lot will be determined by how quickly western economies show signs of slowing. The housing market, already feeling the strain from higher borrowing costs together with consumer spending and labour force participation rates will be key considerations when central banks are considering any reversal decisions with rates.

The strong Dollar has been a prevailing trend for 2022 (fig9.). It has been consistently strong for most of the year, up 20.13% by the end of September, before depreciating throughout Q4, ending the year up +8.96%. The levels seen throughout 2022 have been elevated in absolute and historical terms. Going into next year, a weaker Dollar, to some degree is expected. Euro and Sterling have been appreciating since September from low bases, so it would make sense to see this trend continue.

After such a volatile year as 2022, investor sentiment has been hit hard and will likely take a while to stabilise. We believe that, as 2023 progresses sentiment will recover but only then will we see sustainable re-pricing in the market. Improving corporate earnings and future guidance will be essential in turning things around and there will likely be additional false starts early in the year.

Conclusion

We are anticipating some stability in economic growth during 2023 but this might be a hard-won battle with potential setbacks along the road.

It might take many months for sentiment to rebound, and we may need to see evidence of stabilising corporate earnings before many investors are attracted back to the table.

To access the latest MDD for the Global Equity Fund please click the following link:

Martello Global Equity Fund MDD

Q4 2022 Review and Outlook

This article is for informational purposes only – please read our Terms and Conditions.

2022 began with a heightened sense of uncertainty coupled with increased volatility within major markets. On a month by month basis the Morningstar Developed Markets index monthly return exceeded +/-5.00% for 7 of the 12 months during the year. 2021 was an exceptionally strong year and a correction was overdue, especially when the level of inflation and tightening monetary policies were factored in.

The positioning of portfolios was absolutely critical to rolling returns during the year as markets maintained their risk off stance with the largest sector laggards being technology, consumer discretionary and communications. Towards the end of last year we saw that energy was becoming more and more attractive versus other sectors in the market. This led to an initial weighting to the sector in September of last year, a weighting that was increased throughout the first quarter of this year. The energy sector was a top 3 sector contributor in 6 individual months of 2022 and produced by far the best overall sector return for the year as a whole.

Throughout the first quarter, there was also volatility and downward pricing pressure for fixed income securities due to the Fed beginning their rate rising cycle in March. This led to a traditional 60%/40% portfolio having one of the largest drawdowns on record, YTD in real terms (fig1.). Traditional theory suggests that a portfolio with a distribution of assets between equity and fixed income dampens volatility but during 2022 this was proven to be incorrect.

The communications sector (media streaming and data distribution) was a major beneficiary of the turmoil and disruption caused by the pandemic in 2020 and 2021. Companies such as Alphabet, Netflix, Disney, Facebook reaped the rewards of finding their audiences locked in their homes for many months during the height of the pandemic. This however created very complex and tough comparisons when earnings were released in 2022 as much of the earnings boost appeared as temporary as we emerged to a more normal lifestyle. This resulted in a total reassessment of the valuations for these companies, and most were found to be unsustainable. Most of the share prices revisited pre-pandemic levels causing considerable losses to many investors.

For much of the pandemic, energy demand was suppressed as manufacturers curtailed operations as demand evaporated during the lockdown period. A sudden economic boost, post lockdown, left energy and oil suppliers woefully unprepared after years of under-investment. The hostilities in Ukraine only served to restrict supply further resulting in a spike in oil and gas prices generating temporary excess returns for the suppliers of these essential commodities at the same time as extreme cost pressures were exerted on all heavy energy users. Our overweight allocation to energy stocks coupled with our underweight to technology put us in a good position for the first 5 months of the year.

Under the surface, however, increasing consumer spending, low interest rates and a hot labour market together with easing of lockdown restrictions meant that inflation was increasing at a rapid rate coming into 2022. January saw headline inflation in the US jump to 7.5% (fig2.) with central bank intervention and quantitative tightening needed. Inflationary pressures were not solely due to the energy suppliers, but higher energy costs feeding through the manufacturing system created an extraordinarily broad impact that resulted in price rises for virtually everything we buy. In order to retain their buying power, higher wage claims by consumers completes the virtuous circle of increasing prices generating high wages, creating yet more increasing prices.

The general themes have remained persistent throughout the year with the energy, healthcare and consumer staples sectors producing the most productive results and the technology, consumer discretionary and communications sectors finding 2022 very tough (fig3.). The differences in returns for these two groups is wide with the best three giving an average return of +11.59% and the worst three giving an average return of -28.79%. This highlighting just how important sector & stock allocation was in 2022.

The market is now focusing on the future. Will there be a meaningful recession in 2023? Will individual corporate earnings hold up? Will inflation continue to impact manufacturers and will recent inflationary pressures persist or dissipate during 2023? There are many views of the potential outcomes, but the generally accepted view is that a mild recession is likely in the USA, a deeper economic dip is probable in the UK and Europe and unemployment will likely rise across the globe as staffing is cut to salvage corporate earnings and margins.

We believe that much of these expectations are already priced into equity markets and further equity outflows will only develop in the event that this overriding scenario is notably shifted to the downside. It is evident that the pure number of variables will likely ensure there is no direct path to recovery. These variables include global interest rate direction, economic growth levels, inflation pressures, pandemic outcomes, Ukraine hostilities, the USA frictions with China and extreme currency volatility.

The variables are all interlinked making for a murky picture for anyone trying to identify, where we will be in 12 months.

Global Equity Fund review 2022.

Q1 2022

We entered 2022 showing an overweight to the energy sector, having bought holdings of BP and Exxon Mobil in September 2021. The timing of these additions to the fund put us in a good position early in the year. The start of the year turned out to be very tough for many investors but the Martello Global Equity Fund was notably protected in January and February due to our overweight to the energy sector and our underweight to the technology and communications sectors (fig4.).

By the end of February, the fund was showing a fall of -2.51% compared to the benchmark return of -7.71%. Inflows into the fund were also giving us the potential to add to our financials exposure such as Zurich insurance and Berkshire Hathaway and selected holdings such as Hyatt Hotels and Microsoft.

As the first quarter drew to a close it was clear that our positioning had greatly aided investors in avoiding much of the market volatility with the fund closing out the first quarter with a loss of only -1.39% some +4% ahead of benchmarks.

Q2 2022

The second quarter continued in this theme with our energy exposure prospering, our underweight to the technology and communications sectors also helped us to avoid heavy downside pressure. We decided to relinquish our holding of Amazon as it was becoming clearer that during the post pandemic phase it was becoming harder for Amazon to retain sales growth as consumers now had the option to look to the high street as well as online. In replacement we observed that commodity and raw material prices were on the rise and we began to add exposure to the sector through Glencore, a major supplier of many raw materials (fig5.).

In early May we removed Disney from the portfolio. Subscriptions to their streaming service appeared to improve early in the year, but it became evident that purchasing external content left the unit struggling to turn a profit. Excessive competition in the space from the incumbents Netflix and Amazon Prime meant the option to increase fees was removed and it now looks like this concept is for the longer-term breadth of the company rather than an instant benefit to profits. By the end of May 2022 the fund was now 6% ahead of its benchmark but was showing a dip of -7.19% for the year to date.

June was a very disappointing month for equity markets producing market returns of -7.66%. Most individual sectors showed deeply negative returns as recessionary fears were being raised and US 10-year treasury yields jumped to 3.5%, the highest for 10 years (fig6.).

Q3 2022

July was the toughest month for the Global equity fund as a rally in the hardest hit sectors for 2022 produced strongly positive performances for the technology, and consumer discretionary sectors. Technology, which had been in a downtrend since the start of the year posted a return of +14.50% over a 6 week period up to the end of July. Energy stocks, which had been positive for the entire 6 months of the year, were down -6.90% over the same period. Thankfully, as expected, over the next 3 months until the end of November, these sector trends had reversed with technology stocks down -11.10% and energy stocks up +16.00%. This just highlighting how abrupt and extreme the sector rotations were in 2022.

As technology sectors had been so hard hit in the first six months of 2022 there was always a risk of a temporary relief rally but the strength of this caught market participants by surprise. We believed that higher interest rates and the prospect of a global slowdown would mean that these sector moves would be brief and unsustainable.

There are times when longer-term actions and allocations are contrary to market moves on a shorter time frame. It is during these times that investment managers beliefs are really tested.

During the third quarter of the year, it was clear that a number of companies were being adversely affected by the heightened inflation which was coming through in earnings reported. There was also a post COVID lull, where stocks that had performed exceptionally well during COVID were brought back down to earth with earnings and growth targets being adjusted accordingly by the market. There were a number of mega cap stocks that missed earnings estimates and were heavily punished for it. Netflix, Google, Amazon, Meta (Facebook) and many others were impacted considerably because of the changing customer trends, reduced spending and lower than expected growth.

Q4 2022

Coming into Q4 our weightings and tactical asset allocations remained relatively consistent. We reduced our underweight to technology slightly and banked some profits in financials as well as increasing our weighting to Europe and the UK which has played out well thus far. Heading into the New Year, we will continue to perform another full global pricing model assessment. This provides us with insight, enabling us to assess existing and potentially new holdings within the fund.

Throughout the year on a YTD basis, our sector allocation has been the biggest contribution to alpha generation relative to the market. This demonstrates, that even in a volatile market, we can still rely on our inhouse relative pricing modelling capabilities to weather even the roughest of seas. Our outperformance versus benchmark, +4.14% has been generated by having overweights and underweights to the right sectors.

With regards to individual stock winners we had many successes during the year including Exxon (+87.36%), Schlumberger (+81.22%), BP (+34.14%), Zurich Financial (+15.00%) and AstraZeneca (+18.88%) (fig7.). All against a market performance of -18.31%. At the time or writing, YTD performance for the fund is -14.17% versus a benchmark return of -18.42% representing +4.14% of alpha generation for the year. Whilst negative absolute performance is never desirable, it is essential to minimize losses wherever possible.

2022 will go in the record as a very tough and volatile year. It was also a year where many investors’ methodologies were deeply tested. We believe that our very robust methodology proved itself again to be able to handle even the most volatile times whilst producing productive output.

2023 Outlook

Looking out into 2023, it is easy to get swept up with the negative and worrying rhetoric that seems to be so prevalent, currently. Granted, it is unlikely that equity market returns and the wider economy will match 2021 and caution cannot be thrown to the wind but there will be pockets of opportunity in 2023, as we have seen in 2022.

At Martello, we work with the facts as we see them rather than expectations about the future since these can change considerably as the year progresses. In place of listing a number of views about the year that may or may not come to fruition, it is more advantageous to go through some of the potentially more likely scenarios.

Over the past year, we have seen inflation in nearly all major developed countries increase at some of the fastest rates in history. Primarily due to COVID and its lasting effects on many supply / demand dynamics and hostilities in Ukraine. We have all also been impacted by inflation in the US, Europe and UK. Initially this was thought to be transitory by many central banks but this view has turned out to be mistaken. Thankfully, Inflation seems, potentially, to have now peaked in western economies.

We expect this trend to continue into 2023 (unless there is any substantial adverse effect from the Ukraine conflict) as pricing pressure coming through in the form of energy, food, used cars and raw materials is ebbing. Rising interest rates have also begun to dampen price rises and will likely continue to do so.

In response to the runaway inflation, central banks around the globe initiated some of the fastest rate rises in history to counteract the adverse effects. The US, the UK and the ECB have all increased rates considerably throughout 2022 (fig8.). At Martello, we expect these rate rises to slow and pause in 2023 as they are having their desired effect on inflation globally.

Many expect rates in the US to then begin decreasing later in 2023, however, we believe it is still too early to have any certainty. A lot will be determined by how quickly western economies show signs of slowing. The housing market, already feeling the strain from higher borrowing costs together with consumer spending and labour force participation rates will be key considerations when central banks are considering any reversal decisions with rates.

The strong Dollar has been a prevailing trend for 2022 (fig9.). It has been consistently strong for most of the year, up 20.13% by the end of September, before depreciating throughout Q4, ending the year up +8.96%. The levels seen throughout 2022 have been elevated in absolute and historical terms. Going into next year, a weaker Dollar, to some degree is expected. Euro and Sterling have been appreciating since September from low bases, so it would make sense to see this trend continue.

After such a volatile year as 2022, investor sentiment has been hit hard and will likely take a while to stabilise. We believe that, as 2023 progresses sentiment will recover but only then will we see sustainable re-pricing in the market. Improving corporate earnings and future guidance will be essential in turning things around and there will likely be additional false starts early in the year.

Conclusion

We are anticipating some stability in economic growth during 2023 but this might be a hard-won battle with potential setbacks along the road.

It might take many months for sentiment to rebound, and we may need to see evidence of stabilising corporate earnings before many investors are attracted back to the table.

To access the latest MDD for the Global Equity Fund please click the following link:

Martello Global Equity Fund MDD

Gary Hill

Investment Director