The earnings season for the first quarter of 2024 is winding down, and for the most part the news has been very encouraging. Global stocks are up by c. 11% for the year in US dollar terms, and in the US the rise in the S&P 500 has been driven almost equally between multiple expansion and earnings per share growth. In fact, earnings growth is on track to be 4% for the first quarter, versus 0.7% for the same period in 2023.

This is despite the delay in rate-cuts that were previously expected by now in many of the developed market nations, and a gradual decline in the US Data Surprises index since February. With fourteen of the world’s largest stock markets trading at or near record high levels, it has been the ongoing strength of corporate earnings and balance sheets that have been the main driver for equities so far this year, and this is supported by unusually strong forward guidance for the next quarter and remainder of the year.

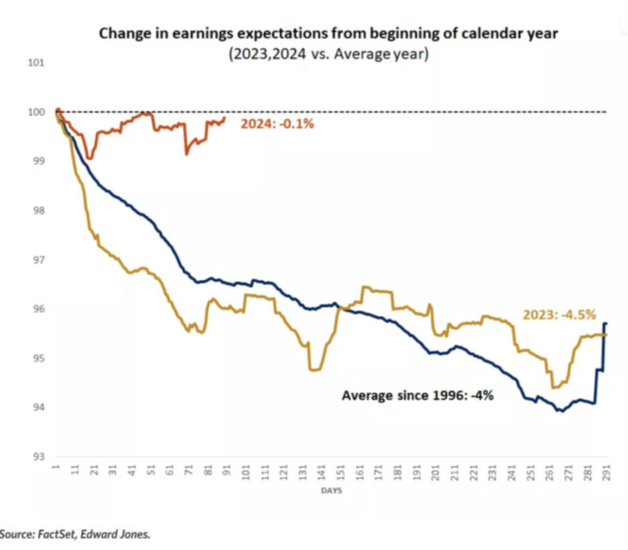

During a typical year, analysts usually begin to revise their initially optimistic earnings estimates by now and continue to do so, resulting in an average 4% revision by the year end. So far in 2024, revisions haven’t followed the historical path lower, and are holding up despite less supportive data from the economy and interest rates. (See chart below)

As the following chart also shows (next page), US earnings remain in a solid uptrend and are also broadening out, becoming less reliant on a narrow group of sectors. Whilst stocks are at or above the previous peak of early 2022, so are earnings, and this is extending now to markets that lagged the US in 2023.

The performance of cyclical sectors and regions such as Europe and Emerging markets suggests that the market is less concerned about the risk of recession, and is anticipating further improvement, from relatively low starting levels, in the second half of the year.

In summary, we believe the following are key takeaways for investors considering the how enduring this rally will be in the second half of 2024:

- Corporate balance sheet health is strong and getting stronger – CEO expectations are improving and this correlates to increased share buybacks six months ahead. Buybacks have recently reached the highest level since 2018 and are projected to grow to $1.1 trillion by 2025. Cash-rich mega cap stocks are a powerful contributor to ongoing equity appetite – US companies buying back stock have been the biggest participant in the market since 2000.

- Headline index valuations (especially in the US) are above 10 year averages, but there remains a wide choice of sectors both there and in other developed markets where earnings growth is expected to be in double digits during the remainder of 2024 and into 2025. This rotation away from a handful of mega-cap tech stocks is still in early stages.

- There are wide performance gaps across sectors, and from companies in the same sector. This is partly attributable to the macro (rate) environment, but also to post-Covid distortions still playing out across markets, hitting different industries at different times. The normal boom/bust cycle and linkages between sectors have been disrupted, creating stock specific opportunities for active managers.

In terms of our global equity strategy, we are currently expressing this optimistic outlook in the following ways: An overweight position in European and UK shares, with an emphasis on sectors such as financials, healthcare, utilities and industrials; An underweight to the US market, selectively avoiding some of the most highly valued tech companies, whilst being overweight a number of key constituents of the global index covering sectors such as communication services, healthcare, financials and energy.